USPIS Asset Seizure

If the United States Postal Inspection Service (USPIS) has confiscated your money, electronics, packages, or any personal belongings, it’s crucial to recognize the reasons behind the seizure and the necessary actions to reclaim your property.

At San Diego Defenders – Forfeiture Law Firm, we specialize in federal forfeiture law and are dedicated to assisting clients whose assets have been seized by USPIS.

Don’t attempt to navigate this process alone or delay until it’s too late. You have the right to contest the seizure, but there are strict timeframes, usually just 30 to 35 days from the date printed on the notice.

Reach out to San Diego Defenders – Forfeiture Law Firm at (619) 258-8888 for a complimentary, confidential consultation. We will go over your legal options and how we can assist you. Our flexible payment plans include affordable installment options and contingency fees, which means you only pay when we win!

Here is an outline of key information about USPIS asset seizure, including how a trustworthy USPIS asset seizure attorney can assist you and what to expect:

- What is the USPIS?

- What Types of Assets Can USPIS Seize and When?

- Reasons Behind USPIS Asset Seizure

- Locations of USPIS Asset Seizures

- How a USPIS Asset Seizure Attorney Can Assist You

What is the USPIS?

The United States Postal Inspection Service serves as the enforcement arm of the U.S. Postal Service (USPS), working to “protect the nation’s mail system from harmful or unlawful activities.”

The USPIS’s authority, process, regulations, and guidelines for asset seizure are detailed in relevant federal laws, such as 39 CFR § 233.7, 18 USC § 983, and 19 USC 1602–1618.

Authorized by 18 USC § 3061, USPIS investigates criminal activities related to the misuse of the mail system.

Per the Department of Justice (DOJ) and USPIS, their mission encompasses safeguarding postal workers, securing the integrity of the nation’s mail infrastructure, and ensuring that crimes involving mail are prosecuted effectively.

What Types of Assets Can USPIS Seize and When?

USPIS can take possession of property they suspect is related to federal criminal activities or is believed to have originated from such activities.

This power primarily stems from federal forfeiture statutes, including 18 USC § 981, 21 USC § 881, and 18 USC § 983.

Commonly seized items may include cash thought to be the result of illegal activities, money orders or checks suspected of fraud, electronics believed to be involved in scams, and mail parcels containing illegal substances or counterfeit items.

These seizures often arise during investigations of mail fraud (18 USC § 1341), wire fraud (18 USC § 1343), identity theft (18 USC § 1028), or drug trafficking (21 USC § 841 and § 846) involving postal services.

Reasons Behind USPIS Asset Seizure

According to 18 USC § 981(a)(1), the Government is empowered to seize assets that are believed to be tied to violations of certain federal crimes, including USPIS asset seizures.

For example, this includes property acquired through fraudulent means or that facilitated criminal activities using the mail system.

Per 18 USC § 983(c), the Government must establish that the property is subject to forfeiture and that a connection exists between the property and the criminal activity by a preponderance of the evidence.

Importantly, a seizure can occur even if you haven’t been charged with a crime.

Locations of USPIS Asset Seizures

Seizures conducted by USPIS can happen at various locations, such as mail processing facilities, local post offices, or during package interceptions.

Additionally, properties may be searched under federal search warrants at personal residences or business locations.

USPIS collaborates with other federal agencies, such as the DEA, IRS, and FBI, especially in more complex cases.

San Diego is notably a key location for cross-border mail seizures, and our firm has experience handling USPIS-related cases throughout California and other states.

How a USPIS Asset Seizure Attorney Can Assist You

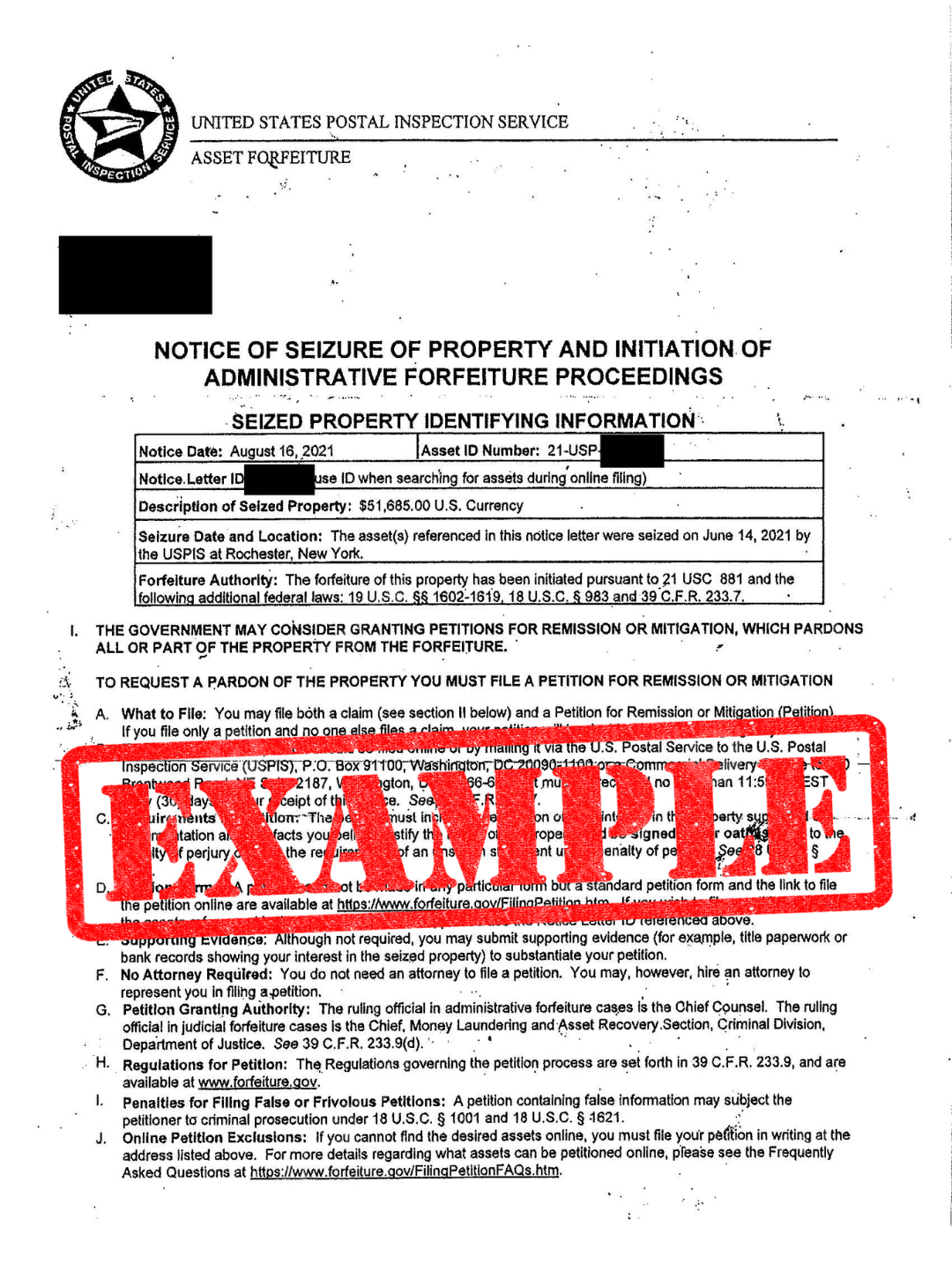

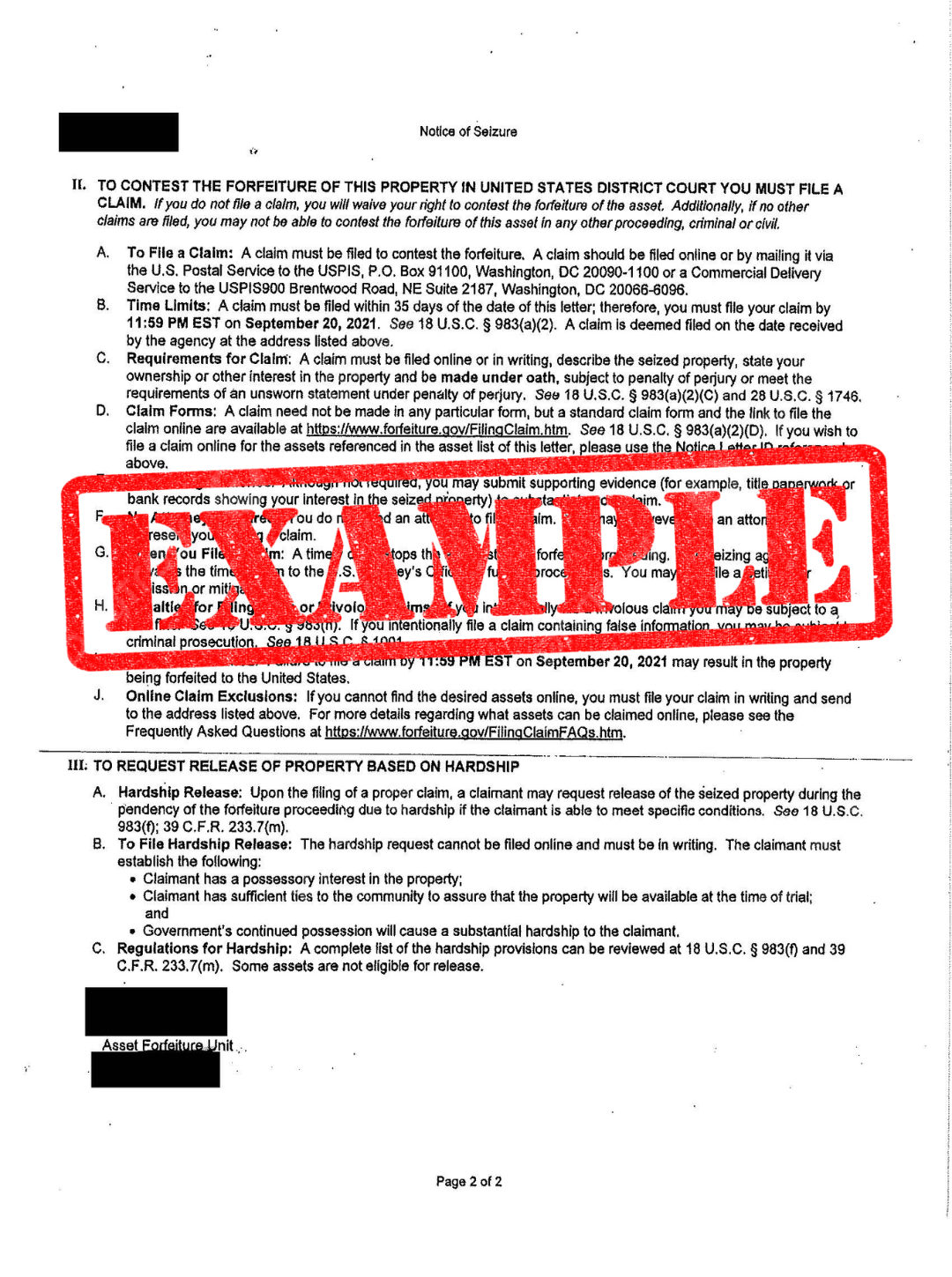

Following a seizure, USPIS or the appropriate federal agency will send you a Notice of Seizure and Initiation of Administrative Forfeiture Proceedings by certified mail, as required by the Civil Asset Forfeiture Reform Act (CAFRA) under 18 USC § 983(a).

You will have a limited timeframe from the date printed on this notice to respond, with options that include:

You will have a limited timeframe from the date printed on this notice to respond, with options that include:- Submitting a petition for remission or mitigation directly to the seizing agency, which does not challenge the seizure’s legality. However, we generally advise against handling this without legal representation since there is no specific timeframe for agency responses.

- Filing a claim for judicial forfeiture, compelling the government to start a civil or criminal forfeiture case in federal court. While it may seem intimidating, this option formally contests the seizure and guarantees your right to due process, in contrast to a petition, which offers limited rights.

Our experienced USPIS asset seizure attorney can file a claim on your behalf. Our firm has 35 years of expertise in federal defense and is well-recognized by federal agencies.

If you do not take action, the government will permanently retain your property.

San Diego Defenders – Forfeiture Law Firm is prepared to evaluate your situation, assist you in filing necessary documents, and represent you in dealings with the U.S. Attorney’s Office or the Postal Inspection Service. Don’t hesitate to call us today at (619) 258-8888!

Reach Out to San Diego Defenders – Forfeiture Law Firm Today!

If you’ve received a seizure notice from USPIS, it’s crucial to act promptly.

There are strict deadlines, and failing to respond in time could lead to the permanent loss of your property.

Contact San Diego Defenders – Forfeiture Law Firm at (619) 258-8888 to arrange a complimentary, confidential consultation.

Alternatively, you can fill out our online Free Case Intake Form here.

Se habla Español.

While we are located in Chula Vista, California, we assist clients facing forfeiture issues across all 50 states.