Understanding Federal Forfeiture

Has the federal government seized your money, vehicle, or other property? Facing forfeiture is an overwhelming experience, and you likely have numerous questions. Contact San Diego Defenders – Forfeiture Law Firm at (619) 258-8888 for a free, confidential consultation. We have over 60 years of combined experience, and we take care of all paperwork, calls, and negotiations throughout the entire process.

Federal forfeiture is a unique legal area distinct from others.

Essentially, your property can be taken and forfeited by the United States Government (referred to as “Government”) without a legal conviction under what is known as Civil Forfeiture.

In contrast, Criminal Forfeiture demands that a criminal conviction occur beforehand.

As a practicing attorney in federal forfeiture and criminal defense, I will make my best efforts to present foundational knowledge while avoiding complex details that often confuse both legal professionals and the general public.

Federal forfeiture laws are defined by statutes that govern federal agencies, including US Customs, HSI, DEA, FBI, USPIS, and USSS.

Civil Forfeiture is articulated in Title 18 § USC 981, 982, and procedural guidelines in 983. Under this framework, a federal law enforcement agency may confiscate assets such as cash, vehicles, and other properties if it claims the assets are reasonably suspected of being obtained through unlawful activities, used in a variety of crimes, or traceable to such illegal actions.

- How Does the Government Justify Federal Forfeiture and Seizures?

- Three Categories of Federal Forfeiture

How Does the Government Justify Federal Forfeiture and Seizures?

Historically, forfeiture dates back to European monarchies, where landlords could reclaim fiefs from farmers who failed to meet specific obligations under their agreement.

Over time, forfeiture evolved, especially in maritime law, allowing authorities to seize ships and their cargo based on ownership claims.

This principle carried over into American law, reflecting the Government’s aim to penalize, deter, and incapacitate criminal enterprises.

However, this process can sometimes be misapplied, either unintentionally or due to excessively aggressive actions by law enforcement.

This creates the need for firms like San Diego Defenders—Forfeiture Law Firm to assist innocent property owners who shouldn’t have to suffer the loss of their belongings, vehicles, or cash.

Three Categories of Federal Forfeiture

1. Administrative Forfeitures

Administrative Forfeitures are the most frequently encountered type, also known as non-judicial forfeitures.

Various “three-letter” federal agencies, such as the DEA, CBP, HSI, and FBI, or USPIS and USSS, can seize property, currency, Bitcoin, vehicles, and more, either via search warrants or at the time of detention, whether or not criminal charges are filed.

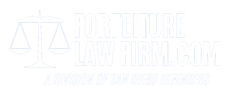

The agency can subsequently transfer the seized property and provide a notice within 60 days through certified mail explaining the claimant’s options and the deadline for filing.

The Notice of Seizure of Intent to Forfeit letter describes your choices under the Election of Proceedings and the timeframe to submit a petition, offer in compromise, abandon, or claim.

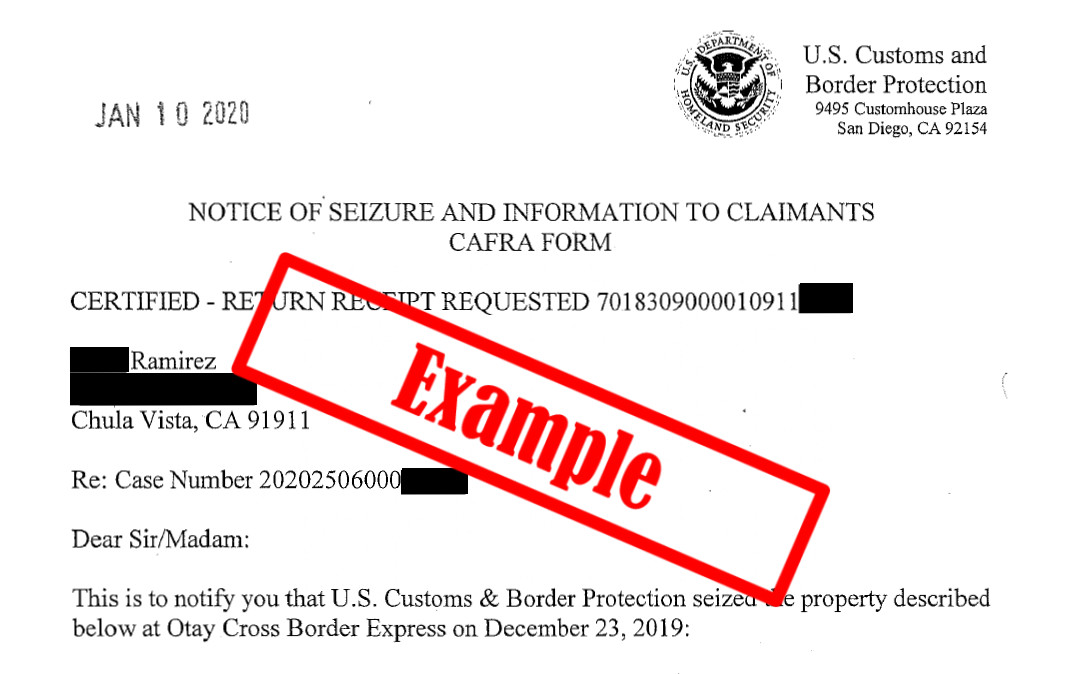

Note that law enforcement agencies like CBP or DEA often encourage filing a petition oroffer in compromise, which places control of the process firmly in their hands without a set timeline.

Any errors made by the claimant during this administrative procedure may result in limited protections.

For advice on recovering your assets and evaluating your chances of success, contact San Diego Defenders – Forfeiture Law Firm for a free, confidential consultation at (619) 258-8888.

2. Civil Forfeiture

Civil Forfeiture takes place when property is seized through the previously mentioned administrative process and is contested following the claimant’s formal claim.

The Government is obligated to file a case in federal court within 90 days.

Seizures may occur under warrant.

For example, in a pyramid scheme scenario, the Government could initiate a civil forfeiture case, and a client could fight for the return of a million dollars.

One such example is The United States of America vs. $1,296,912.00 in Bank Funds in Cathay Bank Account 0462 et al. CV 24-071690ODW.

Because of the extensive process of litigation, i.e. discovery, motions, and possible trial, the Government may decide to negotiate with the asset forfeiture attorney based on both sides’case strengths and weaknesses, as the standard of proof in civil matters is merely a preponderance of the evidence, which translates to just slightly more than 50%.

Thus, in many cases, the claimant must demonstrate that the property, currency, or vehicle in question had no intention of criminal activity or does not trace back to illegal profits.

This is why legal representation is crucial; the saying “a person who represents themselves has a fool for a client” holds especially true in civil forfeiture matters.

Mastery of evidence laws, civil procedure rules, and strong negotiation abilities are essential for successfully reclaiming your property in a federal civil forfeiture case.

3. Criminal Forfeiture and Ancillary Proceedings

Criminal Forfeiture and Ancillary Proceedings are somewhat of a hybrid, where the forfeiture process and property ownership are contested during an Ancillary Proceeding after a criminal case results in a guilty verdict.

Notification is made through publication or a direct written notice to those who may have an interest in the seized property.

Interested third parties can petition the federal court to assert their claims.

When a third party files a petition in federal court, they request a hearing to challenge the preliminary forfeiture order submitted by the Government seeking judicial approval.

While third parties are generally entitled to due process similar to that of civil proceedings—allowing for discovery—the judge has the discretion to rule on the petition without necessitating such discovery.

Complicating the situation further are the two main theories used to assess ownership: equitable distribution and direct traceability of funds to the third parties involved.

This is particularly important in scenarios where multiple third parties are competing for limited funds or property, especially when there is potential commingling of those assets.

For instance, in cases featuring various bank accounts, one account may contain funds from third parties that have been mixed at different times, while another account might hold entirely separate funds.

It is crucial to emphasize that innocent owners have the right to reclaim their property, and no individual should benefit from deceiving third parties.

However, the situation can become murky, often resulting in the Government retaining property deemed unclaimed if it cannot be clearly traced back to the third party.

We’ve noted that this challenge has become increasingly prevalent in cryptocurrency cases involving Bitcoin, Ethereum, and other crypto.

This summary provides an overview of federal forfeiture, but many nuances exist, including state case law that can influence property rights.

For a free, confidential consultation regarding your situation, contact San Diego Defenders – Forfeiture Law Firm at (619) 258-8888.

Keep in mind that timely action is essential, as there are strict deadlines that must be observed.