4 Essential Steps to Take After Receiving a Notice of Seizure from a Government Agency

Take a Moment to Collect Yourself and Review This Overview First!

Receiving a notice of seizure letter from a federal agency, such as the DEA, CBP, FBI, USSS, USPIS or HSI, can be unsettling.

However, it’s important to remember that such a notice is not an indication of criminal charges.

The majority of recipients of these letters are not facing criminal prosecution.

It’s possible, for example, that the DEA has seized your property, which may include cash, vehicles, or valuable items like gold and silver.

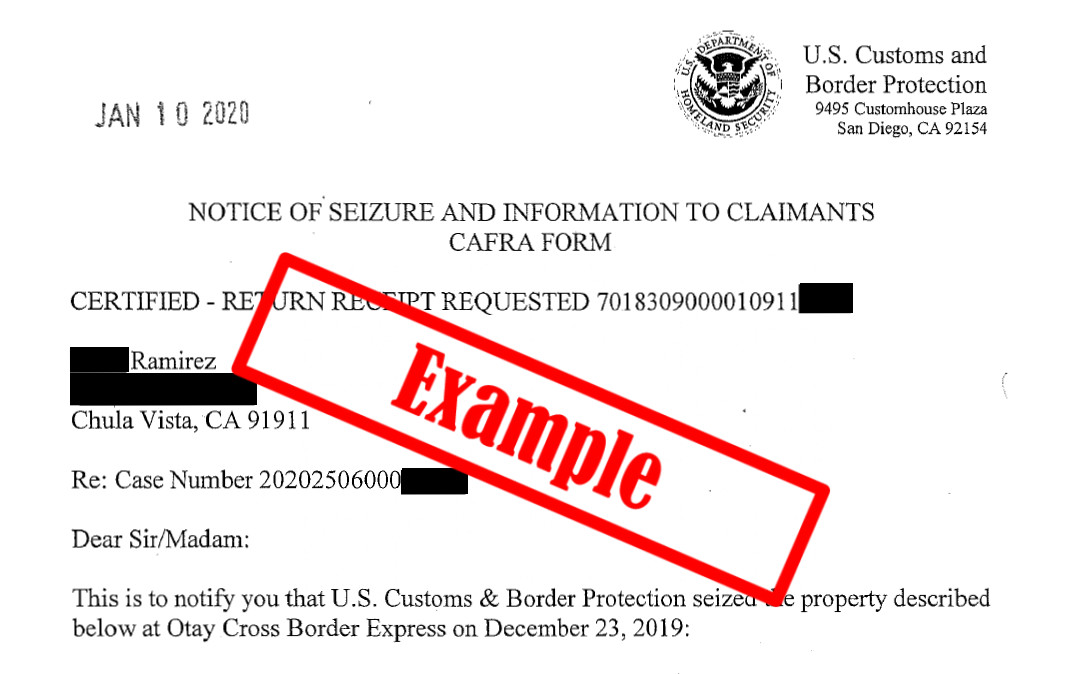

The included CAFRA (Civil Asset Forfeiture Reform Act) Notice of Seizure letter specifies a limited timeframe—typically around 35 days—within which you must file a petition, submit an offer, abandon, or claim.

Choosing the correct approach and providing accurate information under penalty of perjury is crucial.

Feeling anxious upon receiving a seizure notice from the DEA, CBP, FBI, USPIS, or any other agency is perfectly normal.

What’s essential is not allowing that fear to prevent you from claiming your property, particularly because you have not been charged with any crime.

Many individuals successfully recover their seized assets with the help of a qualified forfeiture attorney and the right legal strategy.

Federal agencies often aim to retain your hard-earned property, and they may not prioritize the interests of rightful owners, like your family or spouse.

Avoid contacting agencies such as the DEA or CBP for advice, as they are the ones seeking to forfeit your assets.

- Step 1: Thoroughly Examine the Notice of Seizure

- Step 2: Determine Your Filing Option: Administrative Petition, Offer, or Claim

- Step 3: Agency Response May Require Patience

- Step 4: Assess Whether You’ll Want to Handle the Government Alone

Step 1: Thoroughly Examine the Notice of Seizure

Begin by closely reviewing the details outlined in the notice of seizure letter.

Important elements to look for include:

- The date the letter was issued (this triggers your response timeline)

- Identification numbers for the assets taken

- Descriptions and declared values of the seized items

- The deadline for filing a response (usually 35 days)

Make sure to keep the original notice of seizure letter or create copies for your attorney.

You will likely reference it multiple times during the response process.

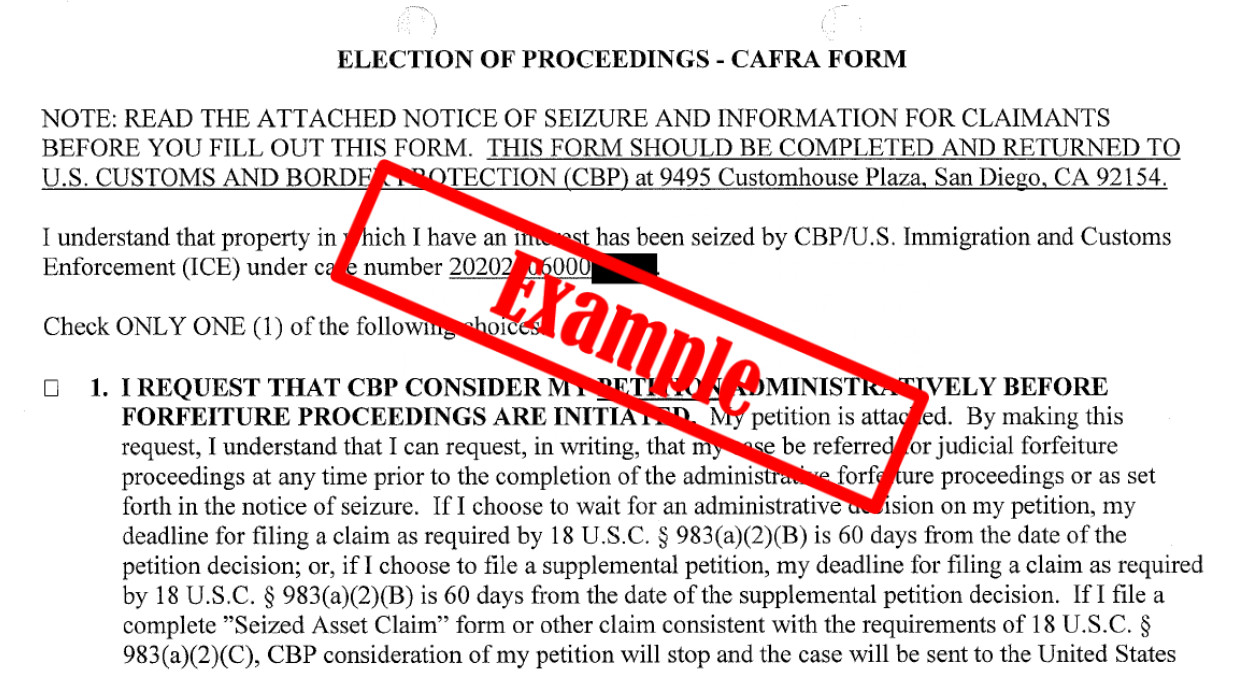

Step 2: Determine Your Filing Option: Administrative Petition, Offer, or Claim

It’s critical to file an administrative petition, an offer, or a claim to seek the return of your property.

Your claim must arrive by the deadline specified in the notice of seizure letter, which is generally 35 days from when you received it.

A formal claim ensures your DUE PROCESS rights, while a petition or compromise offer provides limited rights.

When you respond, use certified mail and maintain detailed records of all correspondence relating to the seizure.

In your response, clearly identify yourself as the property owner, state your interest in the assets, and firmly request their return. Keep the details concise.

If you have uncertainties, it’s advisable to consult a forfeiture attorney before the deadline to prevent waiving any rights.

Contact San Diego Defenders – Forfeiture Law Firm at (619) 258-8888 for a free, confidential consultation. Attorney Dan Smith holds over 35 years of experience in federal defense.

Step 3: Agency Response May Require Patience

Once the agency (like CBP, DEA, USPIS, or FBI) receives your response, they will evaluate your case, possibly along with federal prosecutors.

Here’s what you might expect next:

The agency could deny your petition or offer in compromise, providing you with 60 days to appeal.

Be mindful that if 35 days lapse, you can’t retract a petition or offer to pursue a claim in a forfeiture case.

Should your attorney file a claim, the Assistant United States Attorney (AUSA) may contact your attorney to discuss settlement options before initiating court proceedings.

This often leads to the most expedient resolution, as the government has 90 days to respond to a claim.

If the agency opts to continue forfeiture, they will file a civil suit against your property in federal court.

You will receive notification of the complaint and must file a response within 20 days.

Many fraud cases begin with a complaint against property, such as currency or cryptocurrency, like Bitcoin, e.g., U.S. v. 1,296,000.00 and assorted gold bars.

Notices will be sent to identifiable victims, necessitating a prompt response.

If a federal civil case is filed, hiring an experienced federal forfeiture attorney becomes crucial to defend against the legal action targeting your property.

Your attorney will work to establish the strongest legal arguments and defenses to help you reclaim your assets.

Choosing to settle is often the best outcome for time management, as legal cases can last beyond a year.

Should you respond to the notice of seizure and substantial time passes (typically over 5 years), your attorney may file a motion to dismiss based on unreasonable delays.

Step 4: Assess Whether You’ll Want to Handle the Government Alone

Regarding asset forfeiture, our team operates on a contingency fee basis.

Our success is directly linked to your recovery; our fees are based on the amount returned.

Navigating forfeiture cases can be complex, with numerous pitfalls often set by the seizing agency.

Federal entities like the DEA, FBI, and CBP outline filing a petition and consideration for an offer in compromise as the first two options in your notice of seizure letter.

Both options are termed “administrative” and lack the due process protections associated with formal claims.

Once your property is seized, the government often assumes it will keep it.

For this reason, enlisting the help of a seasoned asset forfeiture attorney can make a significant difference.

Don’t face this situation alone or wait until it’s too late.

Contact our dedicated San Diego Defenders – Forfeiture Law Firm team today at (619) 258-8888 for a free, confidential consultation.

We’ll clarify your options and demonstrate how we can assist you throughout this challenging process.

We also provide flexible payment plans and manage all aspects of your case to safeguard your rights against the government.

Se habla Español.

Our firm is equipped to handle asset forfeiture cases across the nation, including states like Arizona, Texas, Florida, Vermont, Washington, Michigan, New York, and all 50 others.